UK to Finalise Crypto Regulations by 2026; Morocco to End Crypto Ban

According to Reuters, Abdellatif Jouahri, the governor of Morocco’s central bank – the Bank Al Maghrib – said they’re currently working on draft legislation for regulation of crypto assets

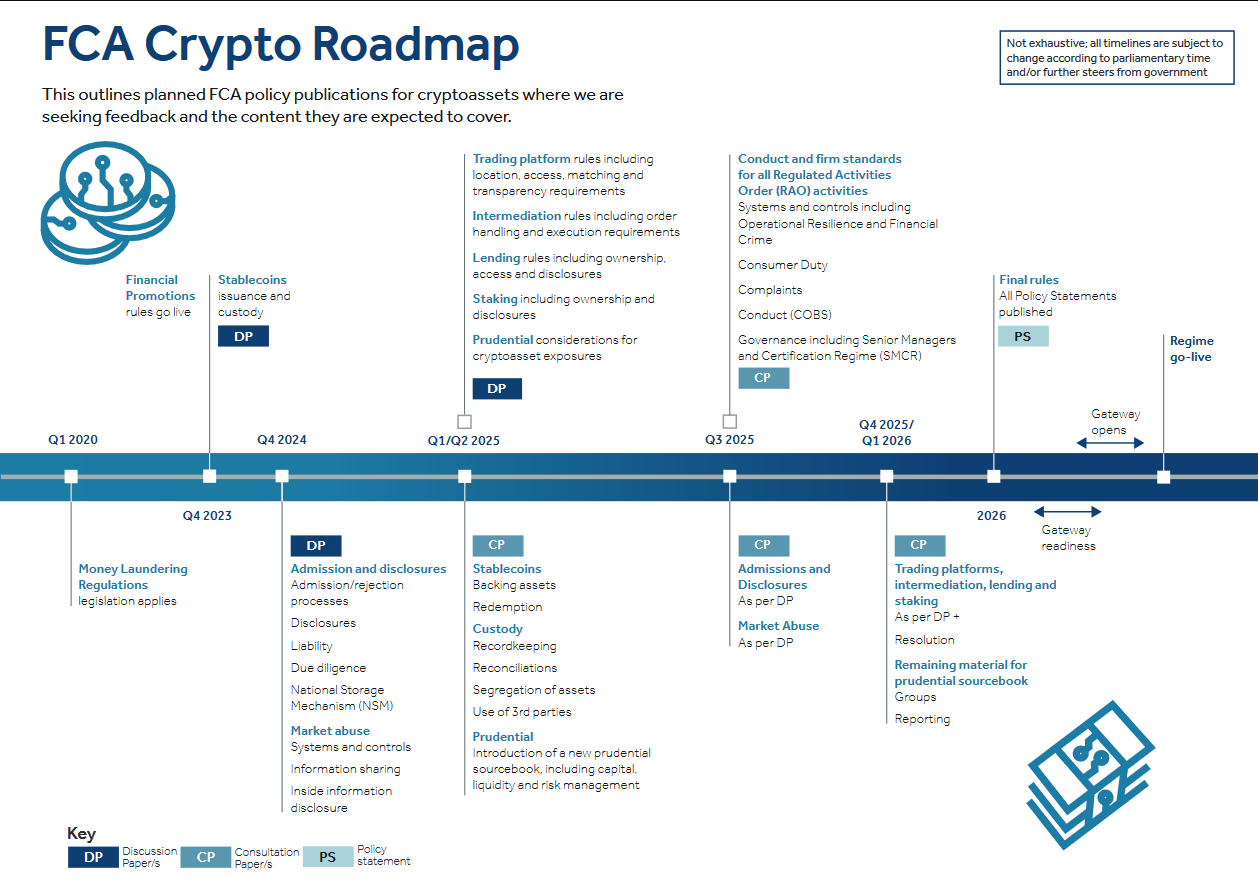

United Kingdom financial regulator, the Financial Conduct Authority (FCA), is catching up on crypto regulation. While the European Union is already in the implementation phase of its Markets in Crypto-Assets Regulation (MiCA), the FCA has just released a study on crypto including a detailed road map.

In its roadmap, the FCA hopes to get feedback in discussion papers and consultation papers on topics such as stablecoins, trading platforms, staking and lending, and custody and other topics. Final comments and statements are expected by 2026, which is when the regime is projected to go live.

Legalise it, Don’t Criticise it

As regulations move along globally, some of the staunchest critics seem to have a change of heart. Morocco, which outright banned cryptocurrencies in 2017, has just greenlighted crypto adoption.

Despite the ban, crypto is popular in Morocco, which ranks 27th in Chainalysis’ global crypto adoption index with US$12.7 billion (AU$19.58 billion) of value received, as per a recent report.

According to Reuters, Abdellatif Jouahri, the governor of Morocco’s central bank – the Bank Al Maghrib – said they’re currently working on draft legislation for regulation of crypto assets.

Speaking at an international conference in Rabat, Jouahri said a central bank digital currency (CBDC) is also in discussion.

Regarding central bank digital currencies, and like many countries around the world, we are exploring to what extent this new form of currency could contribute to achieving certain public policy objectives, particularly in terms of financial inclusion.

Abdellatif Jouahri, governor of Morocco’s central bank

CBDCs are central bank-controlled digital currencies, contrary to decentralised ones like Bitcoin and Co, and are understandably unpopular in crypto circles.