Tether Launches First Gold-Backed Over Collateralized Asset

For example, aUSDT is over-collateralized by Tether Gold but designed to track the value of one US dollar. Its uniqueness lies in the fact that it is backed by physical gold that is stored in Switzerland

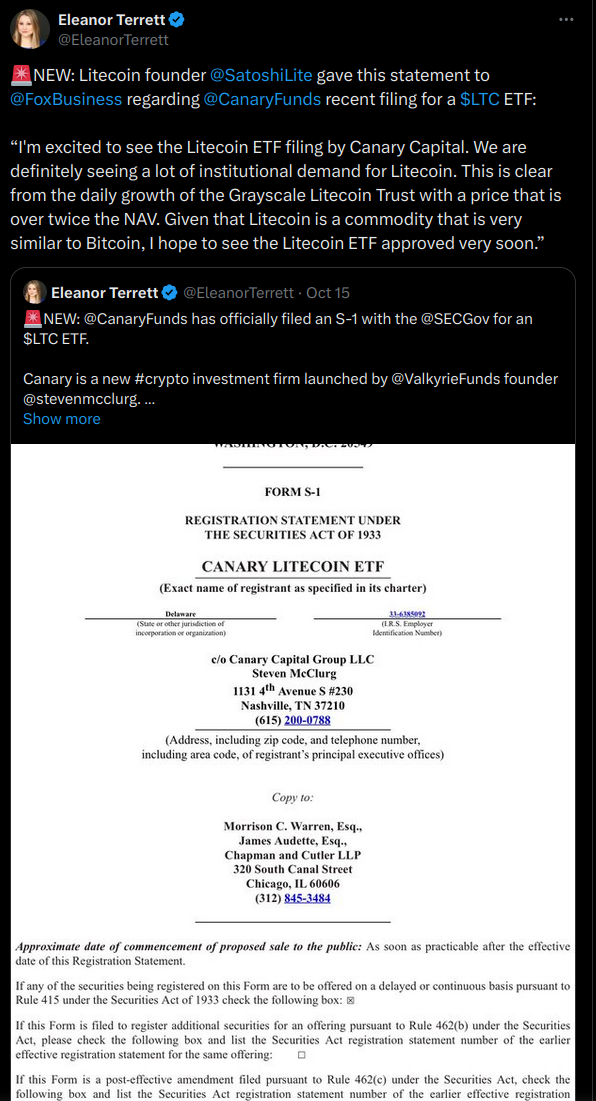

Tether, issuer of the USDT stablecoin, has announced the official launch of Alloy by Tether, with USDT as the first token on its lineup.

Tether Brings Real World Assets to Users

In his X post, Tether CEO Paolo Ardoino described USDT as a synthetic dollar over-collaterized by Tether Gold (XAUt).

Alloy by Tether is a new token minting platform built on the Ethereum (ETH) network. According to its design, it allows users to create tokens collateralized by the firm's tokenized gold. The plan is to integrate Alloy into Tether's digital assets tokenization platform, which will be launched later this year.

Two members of the Tether Group; Moon Gold NA, S.A. de C.V. and Moon Gold El Salvador, S.A. de C.V., developed the Tether gold-backed ground-breaking tethered asset.

This new development aims to redefine stability in the digital economy. It will achieve this by combining the strengths of a stable unit of account with the security and reliability of gold. Alloy by Tether introduces a whole new kind of cryptocurrencies known as Tethered assets. They are specifically designed to track the price of reference assets through various stabilization strategies.

One of such strategies is over-collateralization with liquid assets and secondary market liquidity pools. This is a welcome innovative approach that provides consistent value and stability between the reference asset and its tethered counterpart.

For example, aUSDT is over-collateralized by Tether Gold but designed to track the value of one US dollar. Its uniqueness lies in the fact that it is backed by physical gold that is stored in Switzerland. The USDT smart contract offers transparency to users by keeping track of all collateral and minted tokens. This is done using Price Oracles to constantly evaluate the Mint to Value (MTV) ratio.