SEC to reject bids for spot Solana ETFs

The journey for firms looking to launch crypto ETFs starts with a 19b-4 application with the SEC. This filing outlines the proposed product and includes details about the structure, trading mechanisms and compliance with securities regulations

The United States Securities and Exchange Commission is set to reject applications in line for spot Solana exchange-traded funds (ETFs).

The agency has notified at least two of five issuers seeking approval for a Solana ETF, according to Fox News reporter Eleanor Terrett.

“The consensus here, I’m told, is that the SEC won’t entertain any new crypto ETFs under the current administration,” Terrett said on Dec. 6.

Several asset management firms have recently filed for SOL ETFs, aiming to provide investors with direct exposure to Solana’s market.

VanEck was the first asset manager to submit a 19b-4 application with the agency on June 27, shortly followed by 21Shares on June 28 and Canary Capital in late October. Following Donald Trump’s win in the Nov. 6 presidential elections, Bitwise and Grayscale also applied for a SOL fund.

The journey for firms looking to launch crypto ETFs starts with a 19b-4 application with the SEC. This filing outlines the proposed product and includes details about the structure, trading mechanisms and compliance with securities regulations.

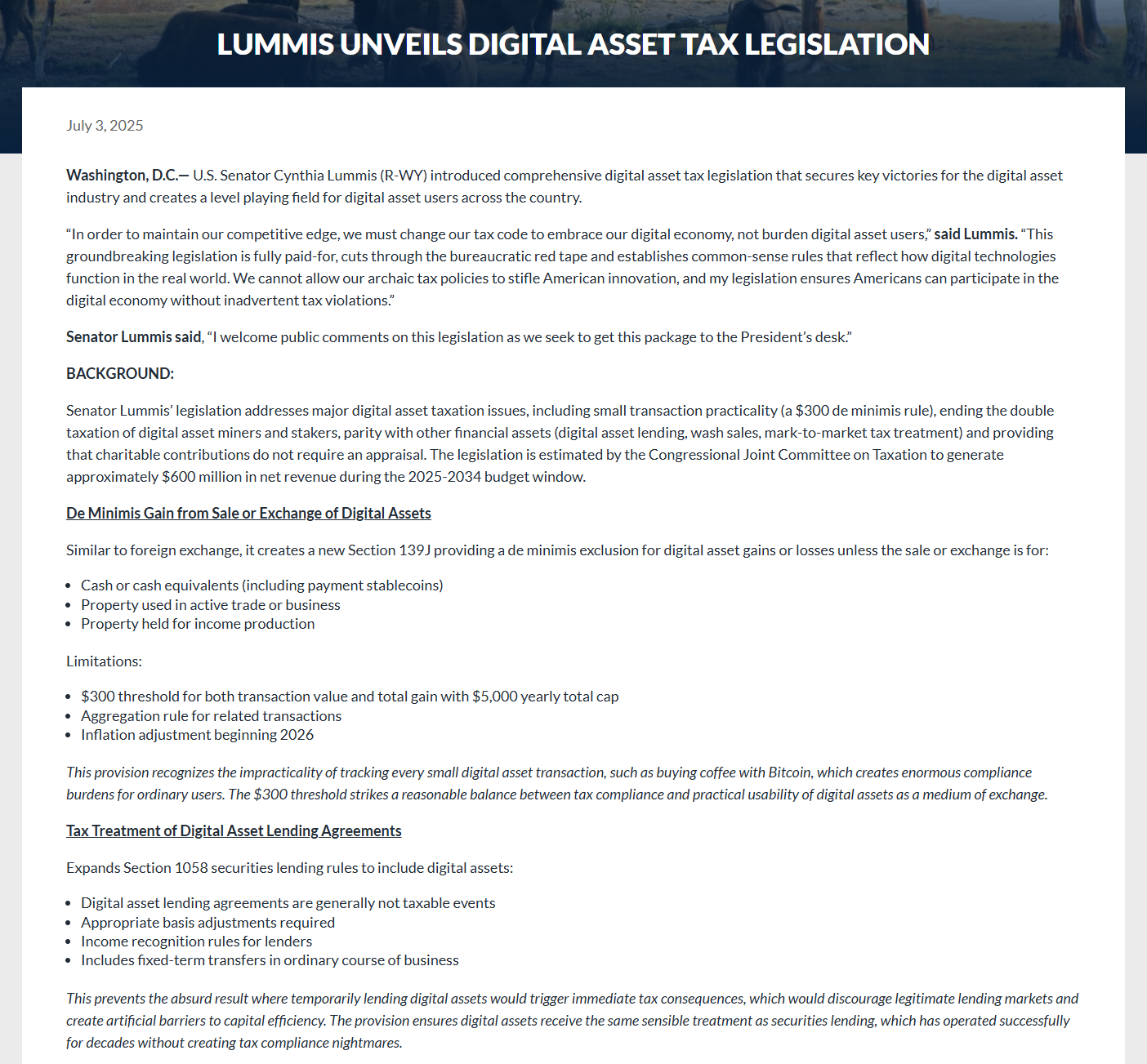

Although a rejection may delay the applications, companies can still seek approval under the agency’s upcoming new leadership. On Dec. 4, Trump nominated Paul Atkins, a crypto policy expert, to run the SEC — fulfilling one of his campaign promises to replace current Chair Gary Gensler.

Terrett anticipates that SOL ETFs will undergo the same treatment as Bitcoin BTC ETFs, with issuers receiving the green light all on the same day:

“The SEC won’t approve just one or a couple and not the others. Remember the bitcoin ETFs? Eleven launched on the same day.”