Santiment allowed a rebound in the BTC exchange rate amid a decrease in the number of non-zero addresses

Over the past ten days, the indicator has decreased by 311,000

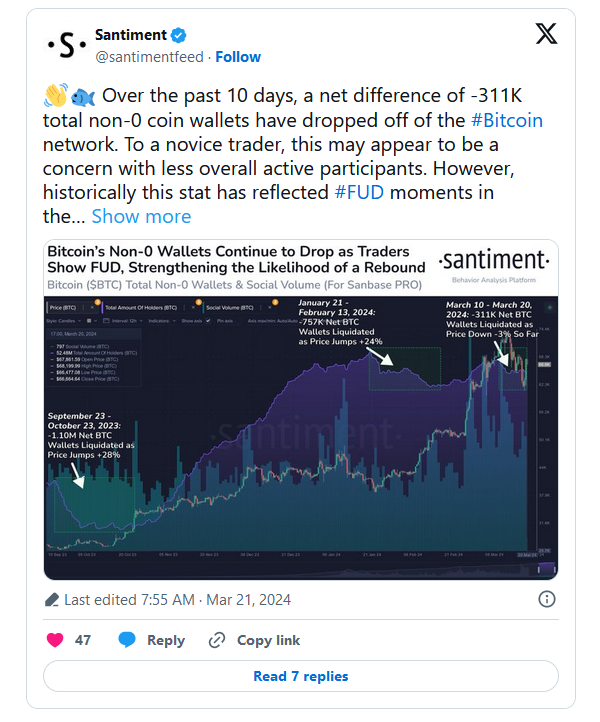

Over the past 10 days, the number of addresses with a non-zero balance has decreased by 311,000 on the Bitcoin network. According to the experts of the analytical company Santiment, for novice traders, reducing the number of active market participants may seem problematic, but historically such statistics reflect moments of panic and capitulation of small holders, followed by a rebound in the exchange rate.

To confirm their words, Santiment cited two situations that unfolded according to this scenario in the past and current years. So, from September 23 to October 23, the number of bitcoin wallets with a non-zero balance decreased by 1.1 million, while the asset rate increased by 28%. From January 21 to February 13, another 757,000 addresses on the network liquidated their savings, after which the value of bitcoin increased by 24%.

From March 10 to March 20, non-zero wallets decreased by 311,000, and the asset rate lost 3% during this period. According to analysts, the first cryptocurrency has every chance to make a rebound even before the decline in the number of non-zero wallets stops. The company explains the outflow by the traders' conviction that the asset has already reached a local peak.

On March 14, bitcoin updated its historical record above $73,600, but by the time of writing it had adjusted by 9% and was trading at $66,925 on Binance. At the same time, the growth since the beginning of the year amounted to 58%.

Earlier, Santiment noted that the crypto market showed a rebound after the US Federal Reserve announced its intention to keep the rate at the same level.