Polygon Community Rejects Proposal To Deploy Bridge Funds into Morpho

“Given the community’s concern around the pre-PIP it seems unlikely for this proposal to progress, but it doesn’t mean innovative or even aggressive ideas shouldn’t be explored in the future.

Ethereum Layer 2 Polygon, has rejected a recent preliminary proposal (pre-PIP) to deploy $1.3 billion of stablecoins in its Proof of Stake bridge into an incentives program to grow its Decentralized Finance (DeFi) ecosystem.

The platform announced the verdict on X on Dec. 17., stating that several community members raised valid concerns over the proposal’s lack of an opt-in mechanism from users.

“Given the community’s concern around the pre-PIP it seems unlikely for this proposal to progress, but it doesn’t mean innovative or even aggressive ideas shouldn’t be explored in the future. The governance community is evidently engaged in Polygon protocol developments,” Polygon wrote in the X post.

Polygon’s pre-PIP gained much attention over the last few days, particularly from partner Aave, who received a counter-proposal from the founder of Aavechan, Marc Zeller, urging it to exit Polygon for security reasons.

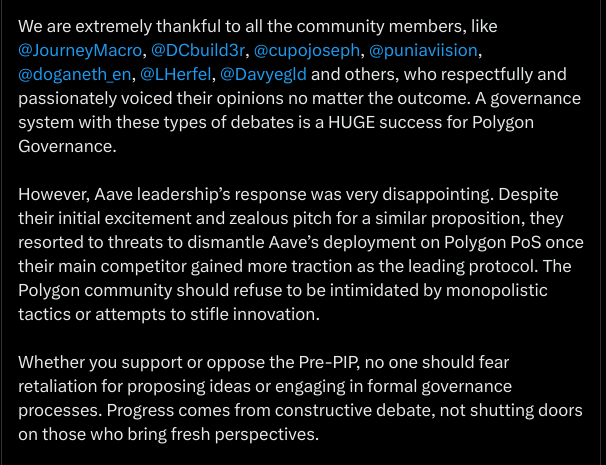

Polygon responded to Aave in their tweet, voicing disappointment over the latter's threats to discontinue its deployment. Polygon said Aave had proposed a similar arrangement to allocate some funds from the stablecoins reserves to its yield-bearing token on Aug. 16.

Polygon also said Aave was only making threats because its main competitor, Morpho, would benefit from the proposal as the chain’s stablecoins would be deployed there.

Polygon’s pre-PIP

The proposal by Allez Labs, Morpho Association, and Yearn suggested that Polygon gradually deploy the stablecoin reserves held on its PoS Portal bridge into Morpho’s liquidity pools for incentive programs to grow its DeFi ecosystem.

They argued that the platform’s PoS bridge was one of the most idle onchain stablecoin holders and could generate around $70 million annually if directed into yield strategies.

Following the proposal, many took to X to criticize the plan, including former Polygon employee Pranav Maheshwari.

“If any underlying yield-generating protocol experiences a hack or financial attack, it could compromise the value of the Polygon assets secured by the bridge, undermining the ecosystem’s stability. This would also result in endangering the assets of people on the Polygon POS chain- making it a bank-run sort of situation,” Maheshwari wrote in an X post.