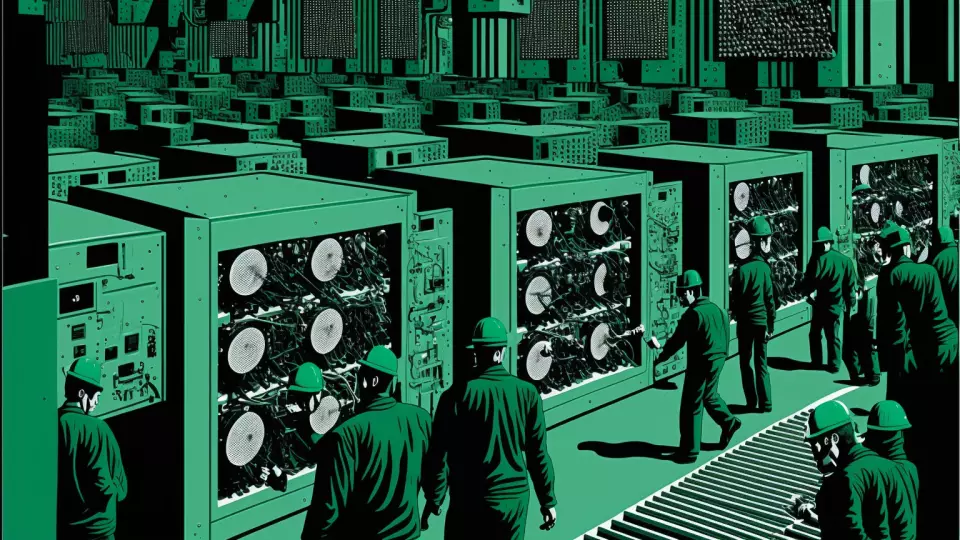

OXLY: More than 50% of miners in Russia work in the legal field

Despite the lack of direct regulation of mining in Russia, more than half of the mining enterprises in the country operate in the legal field. Such statistics were revealed in the OXLY service.

According to OXLY estimates, more than 50% of Russian miners sell computing power for export, which fully complies with current Russian legislation.

"Russian miners, with all their desire to work in a completely legal field, face the problem of generating income to their current account. They can be registered as a legal entity, use official imported and customs-cleared equipment, have contracts with an energy sales and hosting company, but a miner in Russia cannot officially sell bitcoin for cashless and receive proceeds to his current account. Exporting hashrate solves this problem, because in this case the miner does not sell cryptocurrency, but its computing power," said Danatar Atajanov, OXLY's director of service development, on the sidelines of the Crypto Summit 2024 conference in Moscow.

According to him, large mining enterprises establish foreign legal entities that act as buyers of hashrate from Russian companies. A foreign company sells the mined coins and sends part of the proceeds as a payment for computing power to the settlement account of a mining company in Russia.

Medium and small miners do not have the resources to create their own infrastructure that will be able to accept hashrate in other jurisdictions, convert it into cryptocurrency and pay in rubles to a checking account in Russia. They use marketplaces like OXLY that buy and sell computing power for mining.

"A miner from Russia connects to the OXLY service, enters into an agreement with our German legal entity, which buys computing power. Calculations from Russian data centers are supplied to Germany. The service sells mined coins on the crypto exchange in accordance with German law, which allows such activities. Then the marketplace, minus its commission, sends money to Russia, and the miner receives payment for calculations in rubles to his current account. This gives the miner the opportunity to conduct a fully legal business in Russia: receive income to a checking account, pay operating expenses from it, pay taxes on income," Atajanov explained.

This allows the miner to work like an ordinary entrepreneur who sells calculations and for this receives a reward in rubles to his current account.

Russia is one of the largest regions in the world in terms of mining capacity. According to estimates of the Ministry of Finance of the Russian Federation, cryptocurrencies are mined in Russia "for about $ 4 billion, and the profit of miners is about 100 billion rubles," as stated last year by Ivan Chebeskov, director of the Financial policy Department of the Ministry of Finance.

A bill on the regulation of cryptocurrency mining in Russia was submitted to the State Duma in November 2022, but it has not yet been adopted. The bill obliges individuals and legal entities to report to the tax service on the extracted cryptocurrencies with an indication of the transfer address. In February 2024, Osman Kabaloev, head of the Banking Regulation Department of the Financial Policy Department of the Ministry of Finance, announced that the mining bill, which allows, among other things, the use of cryptocurrencies mined in Russia for settlements in international trade, may be adopted in the current parliamentary session.

Source: https://bits.media/oxly-bolee-50-maynerov-v-rossii-rabotayut-v-legalnom-pole/