Maker DAO revealed its plan to propose an accelerated approval of a stablecoin stability measure

n Friday earlier, Maker DAO revealed its plan to propose an accelerated approval of a stablecoin stability measure if some users decide to withdraw a part of the $1.1 billion worth of Real-World Assets (RWA)

On Friday earlier, Maker DAO revealed its plan to propose an accelerated approval of a stablecoin stability measure if some users decide to withdraw a part of the $1.1 billion worth of Real-World Assets (RWA) that are available for redemption on the protocol.

Currently, there is no tilt or pressure in its ecosystem, but Maker DAO believes it is essential to prepare for any erratic user behavior. As part of the measures it is proposing, it wants "adjustments to Maker Vaults, SparkLend DAI Borrow Rate, the PSM, the DSR, and the Governance Security Module (GSM) Pause Delay."

The adjustments include raising the stability fees on different collateral assets registered on the platform from 15% up to 17.25%. Additionally, it plans to increase the SparkLend DAI Borrow APY from the current 6.7% to 16%.

Maker DAO also plans to make PSM Adjustments that will provide a cooling-off period for Debt Ceiling increases to drop from 24 hours to 12 hours. Other measures that will be implemented include the increment of the Dai Savings Rate to 15% and the GSM Pause Delay from 48 hours to 16 hours for faster implementation of future adjustments.

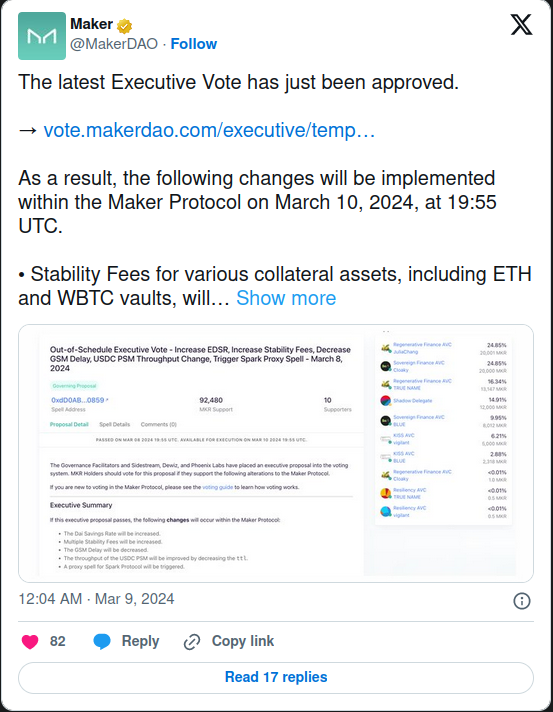

In approximately 24 hours after the proposal was raised, it was approved, and the Maker DAO protocol is on track to implement these changes by March 10, 2024, at 19:55 UTC.