Institutions offloading Ether, $45M sent to Coinbase in hours

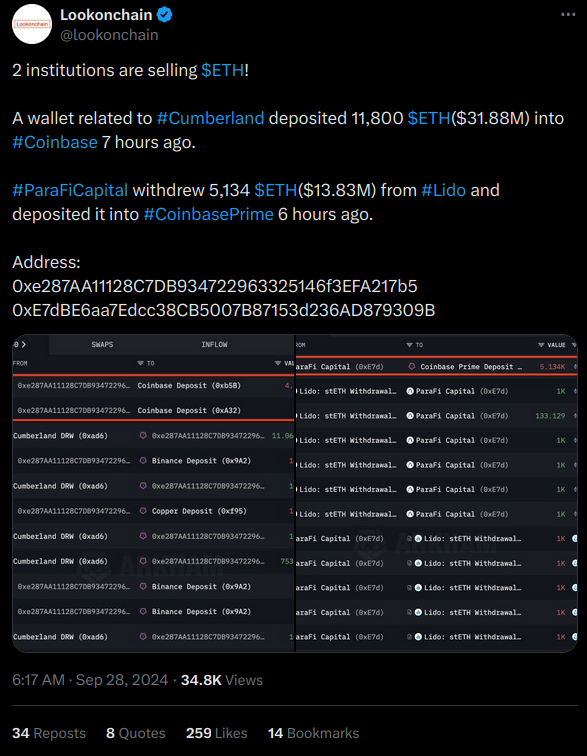

A wallet linked to Cumberland deposited 11,800 Ethereum (approximately worth $31.88 million) into the crypto exchange Coinbase. ParaFi Capital withdrew 5,134 ETH (approximately worth $13.83 million) from Lido and proceeded to deposit it on Coinbase Prime.

Ethereum (ETH) is struggling to follow Bitcoin's (BTC) bullish trend due to high selling pressure. Recently, two institutions decided to sell off Ether, even though the second largest cryptocurrency experienced a slight recovery over the past seven days.

ETH saw a surge of more than 5% over the last seven days, but it is still down by around 20% in the last 90 days. This indicates that Ether has experienced a short-term increase, but it is unable to recover over a longer period, creating a critical opportunity for investors.

Cumberland and ParaFi dump $45M in ETH

Lookonchain data reveals that Cumberland and ParaFi Capital took advantage of the recent ETH surge. A wallet linked to Cumberland deposited 11,800 Ethereum (approximately worth $31.88 million) into the crypto exchange Coinbase. This deposit turned out to be one of the largest dumps made by Cumberland. Previously, on August 26, it had deposited 6,439 ETH (approximately worth $17.66 million) to Binance.

ParaFi Capital is another key institution that considered selling Ethereum amid recent gains. It withdrew 5,134 ETH (approximately worth $13.83 million) from Lido and proceeded to deposit it on Coinbase Prime.