Former U.S. solicitor general exposes regulators’ plans for crypto

Despite the digital asset industry’s pressing need for banking services, federal regulators have waged a concerted, coordinated campaign to debank the industry

In this post:

Former US solicitor generals Donald Verrilli and Paul Clement have accused the Fed and the OCC of trying to debank crypto.

Despite approving crypto-based ETFs, the SEC’s stance on crypto hasn’t really changed.

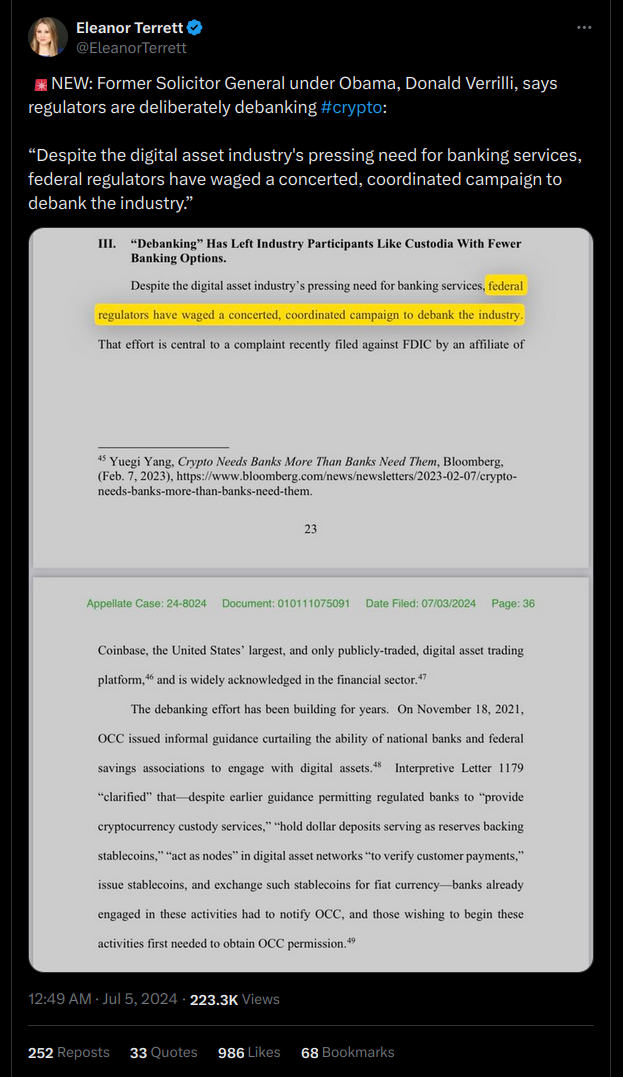

Donald Verrilli, U.S. solicitor general during Barack Obama’s era and Grayscale’s top legal strategist, has accused federal regulators of trying to debank crypto.

Donald made his accusations in an amicus brief alongside Paul Clement, who was the solicitor general during George W. Bush’s era. In the amicus brief, Donald and Paul represent Blockchain Association in support of an appeal from Custodia Bank.

After a March decision in the District Court of Wyoming, Custodia appealed to the Tenth Circuit. They challenged the Federal Reserve’s decision to deny the bank access to a master account.

The Fed is a threat to crypto

Donald believes that the Fed’s action sets a very dangerous precedent. He added that the Office of the Comptroller of the Currency (OCC) has issued informal guidance that restricts banks’ ability to engage with crypto firms.

This empowers federal regulators’ mission to debank the industry.

“Despite the digital asset industry’s pressing need for banking services, federal regulators have waged a concerted, coordinated campaign to debank the industry.”

— Donald Verrilli

The guidelines are not even official, says Donald. They force ridiculously strict requirements for the banks, deliberately making them hard to meet.

The brief argues that this is the real reason why the industry has been unable to properly take off in the country.

Economists have warned that without adaptive regulations, the U.S. will lose its competitive edge in the global crypto market. The country is already losing its influence on traditional finance thanks to efforts from Russia and China.

SEC might cost Biden the election

Still, though. With the presidential election incoming, bipartisan support for crypto-friendly policies look more possible than ever.

That has not stopped Gary Gensler’s SEC from stomping on crypto-centered companies like Coinbase, Rippe, Tether, and Consensys.

Though he has approved both spot Bitcoin ETFs and spot Ethereum ETFs, it’s clear that Gary’s opinion on crypto hasn’t changed much. Ripple’s CEO Brad Garlinghouse has said that if Joe Biden loses the election, it’d be because of Gary.

Donald Trump has weaponized Biden’s crypto cluelessness. He has managed to establish himself as THE crypto-friendly candidate. The man publicly declared his love for Bitcoin and crypto companies weeks ago.

Industry leaders Winklevoss twins, Brian Armstrong, and Brad himself have shown support for Trump. It’s safe to assume that everyone in the crypto community will be voting for Trump come November.

The deal is Biden doesn’t actually, fully understand crypto and the blockchain. Gary, however, has become the face of Biden administration’s position on the industry. Just two months ago, Gary said:

“Crypto is a small piece of our overall markets. But, it’s an outsized piece of the scams and frauds and problems in the markets.”

Donald Verrilli’s amicus brief has triggered a rampant surge in FireGaryGensler on Crypto Twitter. Interestingly, Biden has subtly made a change to his perception of crypto, likely inspired by Trump.