Convictions for crime related to crypto total 272 years in jail over past decade

Social Capital Markets reported that key crypto players have been sentenced to 272 years of combined prison time. Between 2019 and 2023, crypto-related convictions surged, reflecting growing enforcement action. The conviction rate increased by 267%

Crypto leaders have faced continued legal scrutiny over the past few years, with several high-profile figures receiving lengthy prison sentences. In a recent study into jail sentences in crypto, Social Capital Markets draws parallels to the prosecution of bankers after the 2008 financial crisis.

Social Capital Markets reported that key crypto players have been sentenced to 272 years of combined prison time. Between 2019 and 2023, crypto-related convictions surged, reflecting growing enforcement action. The conviction rate increased by 267%, indicating a sharp rise in prosecutorial success against crypto-related offenses.

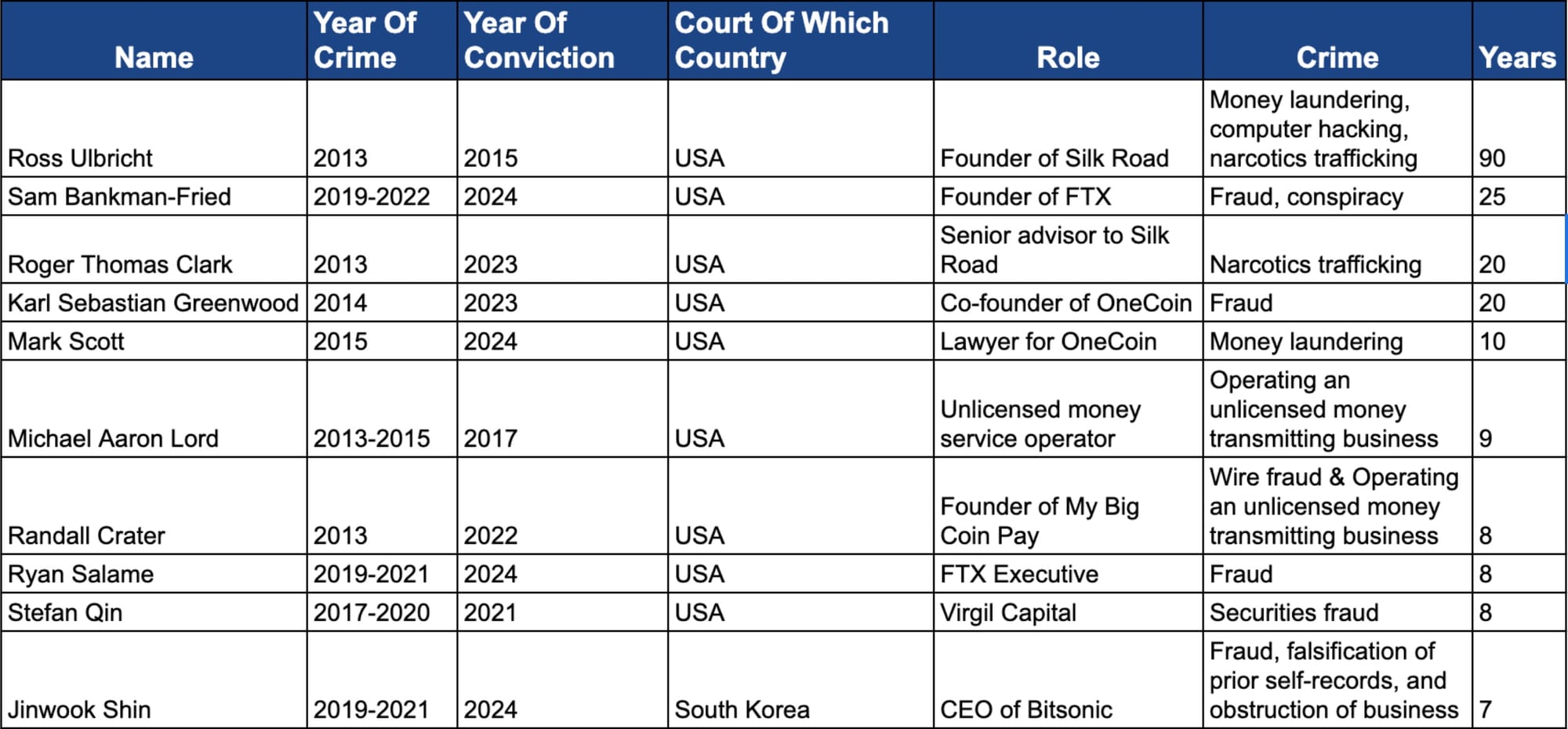

Ross Ulbricht, founder of the darknet marketplace Silk Road, received the harshest sentence to date in 2015 with double life imprisonment plus 40 years. His case illustrates the severe legal penalties given to those involved in illicit activities using cryptocurrencies. More than 10% of convicted crypto criminals in the US have been sentenced to over 20 years in prison.

The average prison sentence in the top 10 crypto cases exceeds 20 years. Money laundering and fraud account for nearly 60% of the longest sentences in crypto crimes. 63% of convictions (26) occurred in the last three years.

Figures like Karl Sebastian Greenwood, co-founder of OneCoin, have faced substantial prison time for orchestrating fraudulent schemes. Greenwood was sentenced to 20 years for his role in one of the largest Ponzi schemes in crypto history.

The United States has imposed harsh penalties, influencing global standards in the crackdown on financial crimes within the crypto industry. This stance may indicate that the industry is maturing and being held to higher standards, similar to traditional financial systems. However, there is also controversy, injustice, and discontent from within the industry, with many rallying around people such as Ulbricht, Tornado Cash developer Alexey Pertsev, and Binance executive Tigran Gambaryan.

Further, a disparity exists between how crypto criminals and traditional financial offenders are treated. High-profile figures in crypto have received severe penalties, while executives responsible for traditional financial crises have often avoided prison, opting for settlements and fines instead. This raises questions about fairness in sentencing and whether crypto criminals are being treated more harshly.

Data shows that crypto-related crimes and convictions have increased over the past decade. The highest number of crimes occurred in 2013 and 2014, while convictions have risen steadily. This trend suggests both delayed legal action and growing enforcement efforts.

The U.S.-driven crackdown could be seen as a commitment to regulating crypto and deterring illicit activities. However, some see it as regulation by enforcement that misses the nuances of the facets at play. For instance, Sam Bankman-Fried received severe sentences for his crimes related to failed exchange FTX. However, the majority, if not all, of Bankman-Fried’s crimes were crypto-related as opposed to on-chain crimes. In reality, his fraudulent activities were akin to those seen throughout Wall Street for decades, using client funds for personal gain.

According to Social Capital Markets, the industry faces a pivotal question: Are these harsh sentences a move to set an example or a sign that the crypto sector is being integrated into the broader regulatory framework governing traditional finance?