Cantor Fitzgerald Acquires 5% Stake in Stablecoin Issuer Tether, Valued up to $600M

The Wall Street Journal reported on Nov. 24 that Cantor Fitzgerald’s involvement with Tether could bolster the stablecoin issuer’s standing amid increasing regulatory scrutiny

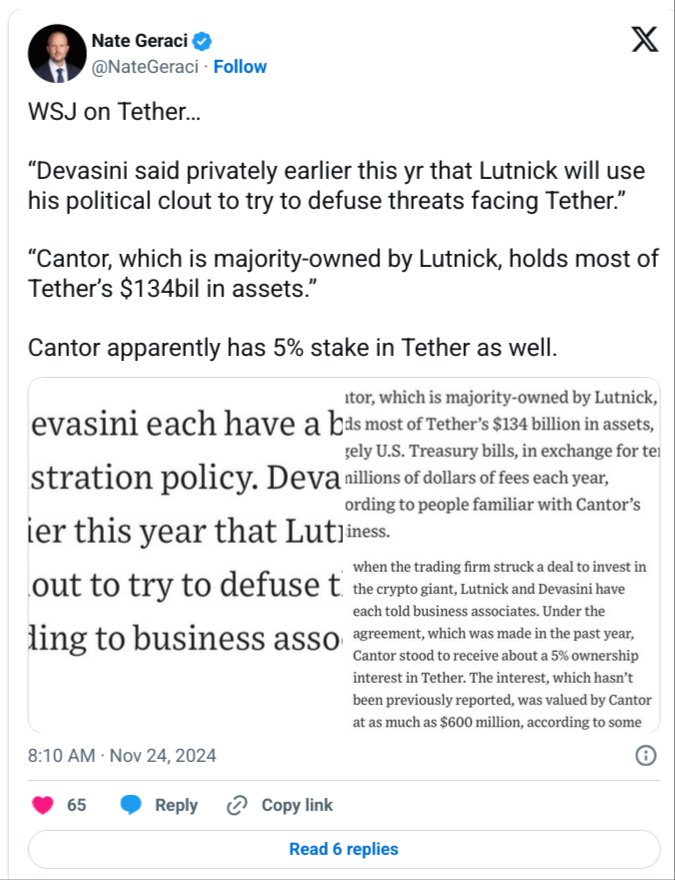

Financial services giant Cantor Fitzgerald has reportedly acquired a 5% stake in Tether, the world’s largest stablecoin issuer, in a deal valued at up to $600 million.

The acquisition, which occurred within the past year, positions the firm to potentially leverage political influence through its CEO Howard Lutnick, who was recently appointed as U.S. President-Elect Donald Trump’s Secretary of Commerce.

The Wall Street Journal reported on Nov. 24 that Cantor Fitzgerald’s involvement with Tether could bolster the stablecoin issuer’s standing amid increasing regulatory scrutiny.

Tether Continues to Face Controversy

Tether has faced ongoing investigations from the U.S. Attorney’s Office for the Southern District of New York regarding alleged use of its stablecoin, USDT, in illicit activities such as terrorism financing.

Amid these challenges, Lutnick’s political clout may play a pivotal role in navigating regulatory hurdles.

Tether’s largest shareholder, Giancarlo Devasini, reportedly expressed confidence in Lutnick’s ability to “defuse threats facing Tether,” according to sources cited in the WSJ.

Lutnick, who has been working closely with Trump as a transition advisor, is vetting candidates for key government roles, some of which could directly impact oversight of Tether.

He is expected to step down as Cantor Fitzgerald’s CEO upon Senate confirmation of his cabinet position.