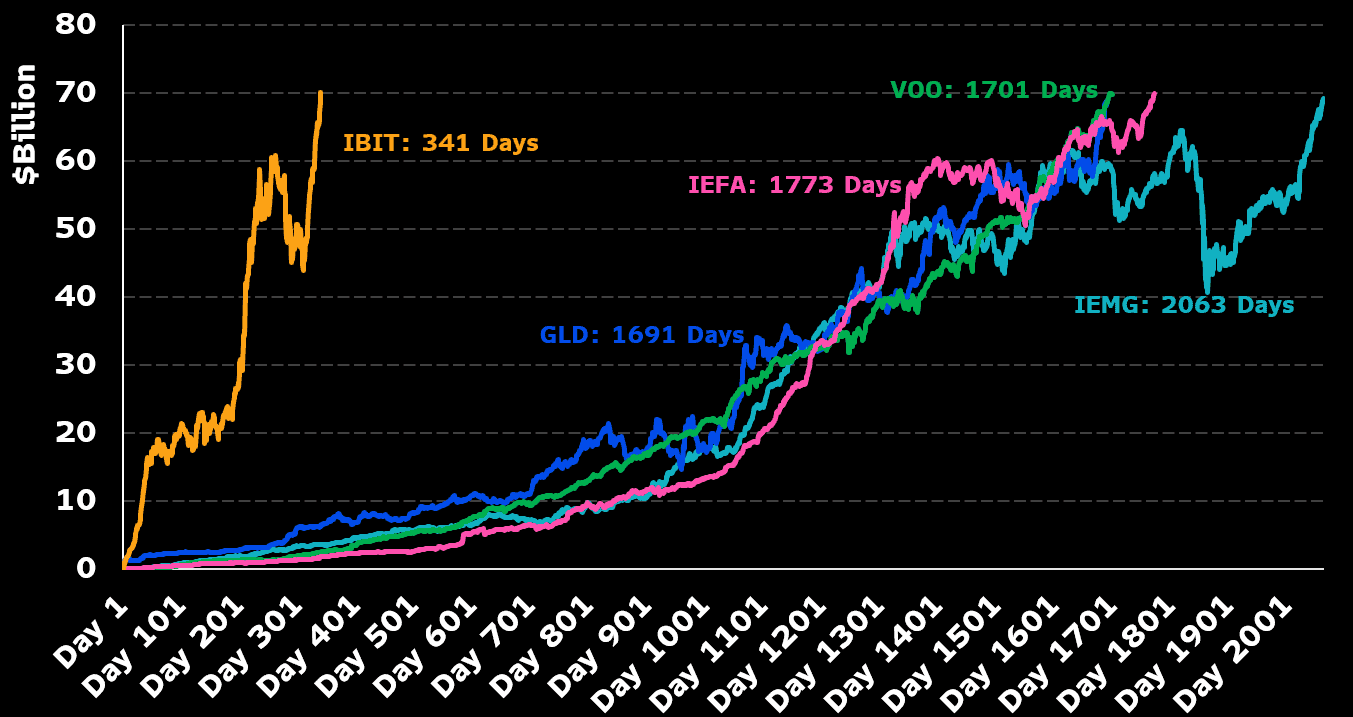

BlackRock’s $IBIT Breaks ETF Record, Hits $70B in Just 341 Days

BlackRock’s iShares Bitcoin Trust ($IBIT) has hit a major milestone, signaling a transformative moment for both ETFs and the crypto market. Merkle Tree Capital reports it reached $70 billion AUM in just 341 days the fastest any ETF has achieved this fea

BlackRock’s iShares Bitcoin Trust ($IBIT) has hit a major milestone, signaling a transformative moment for both ETFs and the crypto market. Merkle Tree Capital reports it reached $70 billion AUM in just 341 days the fastest any ETF has achieved this feat.

The achievement highlights increasing investor confidence in crypto-backed assets and indicates a shift in financial markets. For comparison, SPDR Gold Shares (GLD) took 1,691 days to reach the same AUM. $IBIT’s accelerated trajectory suggests Bitcoin is gaining ground as a modern alternative to traditional safe-haven investments like gold.

BlackRock Drives Surging Crypto ETF Demand

The explosive growth of BlackRock’s $IBIT showcases a surging appetite for regulated cryptocurrency exposure. As the world’s largest asset manager, BlackRock’s involvement lends further credibility to Bitcoin’s role in modern finance. This has helped solidify Bitcoin’s image as a viable store of value in both retail and institutional portfolios.

Analysts argue this development reflects a maturing perception of Bitcoin among Wall Street firms. The continued inflow of capital into $IBIT has helped support Bitcoin’s price stability, even during periods of heightened global economic tension. The fund now serves as a benchmark for other crypto ETFs entering the market.