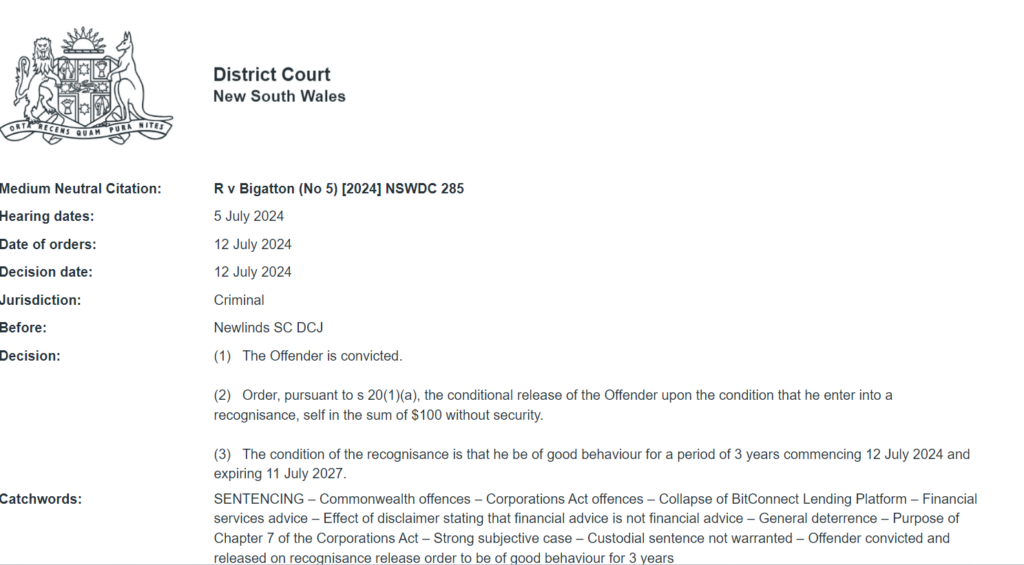

BitConnect Promoter John Bigatton Banned for 5 Years by Sydney Court

The ASIC stated that Bigatton’s actions were in direct violation of regulatory standards, which resulted in his disqualification from managing corporations for the next five years

John Bigatton Banned for Promoting BitConnect Without a License

Bigatton actively promoted BitConnect between August 2017 and January 2018. During this time, he conducted seminars and used social media to endorse the exchange.

The Australian Securities and Investments Commission (ASIC) revealed that Bigatton did not have the necessary financial services license to offer such advice.

The ASIC stated that Bigatton’s actions were in direct violation of regulatory standards, which resulted in his disqualification from managing corporations for the next five years.

BitConnect Promoter’s Bold Claims and Legal Consequences

BitConnect, established in 2016, was known for its digital token, BitConnect Coin, which users could exchange for Bitcoin. Bigatton claimed the token was superior to traditional investments and predicted it would reach $1,000. These claims were part of his efforts to attract investors.

The unlicensed financial advice provided by Bigatton undermines trust in Australia’s financial services industry, remarked Sarah Court, Deputy Chair of ASIC.

The ASIC has been vigilant in regulating the financial services sector. In 2020, they imposed a seven-year ban on Bigatton, preventing him from providing financial services. This recent five-year ban further emphasizes the severity of his actions.

In 2021, the United States Securities and Exchange Commission (SEC) sued BitConnect founder Satish Kumbhani. The SEC accused Kumbhani of fraudulently raising about $2 billion from investors. Despite a court order for restitution of $17 million, Kumbhani’s whereabouts remain unknown as of 2024.

ASIC Freezes Bigatton’s Assets, Secures Guilty Plea in 2024

In 2018, the ASIC applied to the Federal Court to freeze Bigatton’s assets, including his cryptocurrency holdings. This was the first instance of the Australian regulator obtaining freezing orders over digital assets.

Bigatton’s guilty plea in May 2024 was a significant development. According to an ASIC statement dated May 17, Bigatton admitted to promoting BitConnect and providing financial advice without proper authorization. The ASIC alleged that he had advised on six occasions at various locations across Australia.