Binance and Coinbase record $9.3 billion in stablecoin inflows following Trump’s win; Crypto Traders Lean Toward Leveraged Long Positions following Trump’s win

Commenting on how the market has reacted to Trump’s ascent to the Oval Office, the Bybit and Block Scholes report said leveraged positions, which had unwound during pre-election spot volatility, have since rebounded. This led to a rise in open interest across both perpetuals and futures

According to crypto analytics firm CryptoQuant, Binance and Coinbase recorded significant stablecoin inflows after Donald Trump’s win. The firm highlighted that inflows of this magnitude were last experienced in 2020.

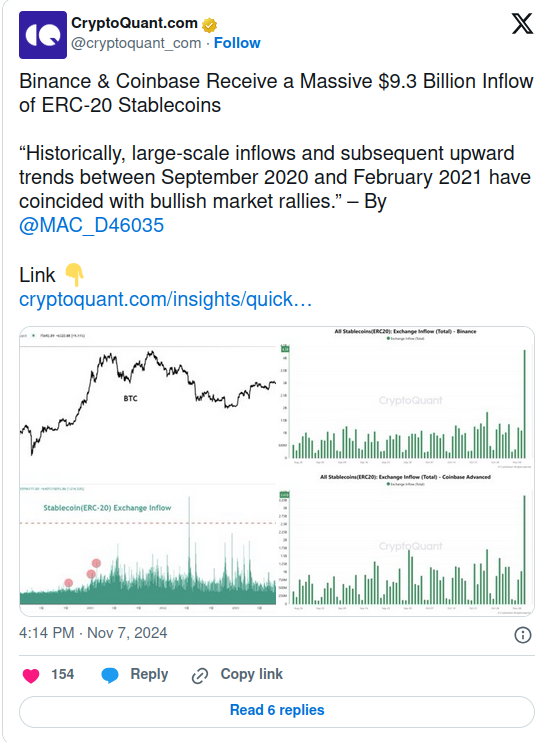

CryptoQuant, an on-chain analytics firm, revealed that Binance and Coinbase recorded $9.3 billion worth of stablecoin inflows shortly after Donald Trump’s presidential win. The firm inferred that these inflows to the Ethereum network could lead to prolonged bullish market trends.

Major exchanges record increased inflows in ERC-20 stablecoins

According to CryptoQuant data, the influx of ERC-20 stablecoins is the second largest in the crypto market’s history. The analytics firm suggested the inflows could result from consumer optimism following Donald Trump’s win, which is perceived as favorable for the crypto ecosystem.

The increased inflows have reportedly triggered a ripple effect across the crypto market as Bitcoin and Ethereum also registered price surges. Bitcoin reached its all-time high of $77,199, while the fear and greed index remained at 70. Ethereum also gained over 7% in the last 24 hours.

Trump’s Victory Brings Stability to Markets

According to a new report by Bybit and Block Scholes, market trends in the period immediately after the U.S. elections suggest traders are leaning strongly toward leveraged long positions, especially in perpetuals and futures contracts. The preference, the report adds, shows traders believe that short-term market volatility has subsided, indicating a more stable environment.

The period has also been characterized by renewed interest in “directional bets” and robust trading volumes. The change in these metrics indicates users’ willingness to capitalize on positive post-election movement and sustained market activity respectively.

As market data in the hours before confirmation of Donald Trump’s victory shows, the USD value of bitcoin (BTC) surged, indicating the crypto community’s excitement at the prospect of having two pro-crypto individuals in the United States’ highest office. As reported by Bitcoin.com News, the top crypto asset briefly surged past $77,000 and some market observers now assert that this rally is likely to continue into the foreseeable future.

Commenting on how the market has reacted to Trump’s ascent to the Oval Office, the Bybit and Block Scholes report said leveraged positions, which had unwound during pre-election spot volatility, have since rebounded. This led to a rise in open interest across both perpetuals and futures. The report added:

Despite the passing of the event risk, positioning across all markets remains close to all-time highs, indicating that traders are willing to continue to pay for leveraged long exposure as BTC trades at all-time highs.

The report suggests that BTC continues to dominate futures and derivatives markets, indicating that a significant rotation of capital into ether (ETH) contracts has yet to occur.