VanEck CEO Provides A ‘Reasonable’ Target For Bitcoin Based On Gold’s Value; BlackRock’s Bitcoin ETF has now surpassed its Gold ETF

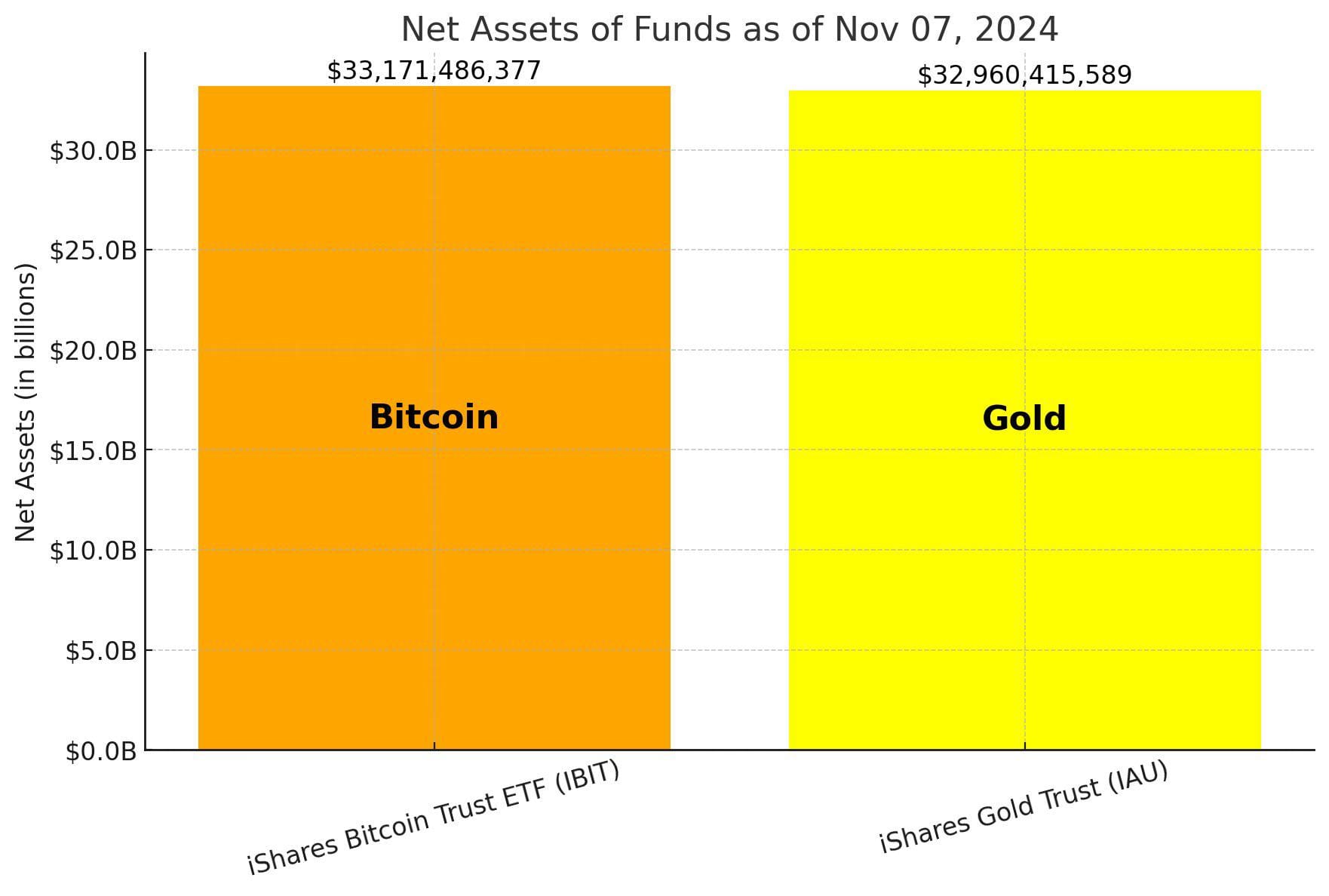

Meanwhile, BlackRock’s Bitcoin ETF has now surpassed its Gold ETF in Assets, $33 Billion Assets in just 10 months, Gold ETF was launched in January 2005

Jan Van Eck, VanEck CEO, recently shared a bold prediction, suggesting Bitcoin’s value could rise to around $300,000.

This estimate, he explained, is based on the coin eventually reaching half the market cap of all the gold in circulation, which he considers a “reasonable, base assumption.” Rather than envisioning the cryptocurrency completely replacing gold as a store of value, Van Eck sees it as achieving a substantial portion of gold’s standing, driven by its appeal as “digital gold.”

Van Eck added that BTC, that recently reached its ATH of $77K, has witnessed much more significant gains this year, partly driven by the interest of individual investors. As he cited, the fresh performance and the soaring demand for Bitcoin ETFs depict their increasing role in the US financial landscape.

VanEck CEO said this has attracted a substantial number of individual investors to the asset class, making it even a political talking point in Ohio’s Senate race and the appearance of Trump at a Bitcoin convention. Van Eck now hopes this popularity brings bipartisan support in the US, further cementing BTC as an asset class worthy of continued growth.

But Van Eck doesn’t espouse a maximalist view in which BTC replaces gold entirely. He thinks the $300,000 target is just a reasonable base case, assuming it captures roughly 50% of the value of gold. That, he said, is a more conservative view than others who believe the coin will eventually supplant gold as the best store of value.

Meanwhile, BlackRock’s Bitcoin ETF has now surpassed its Gold ETF in Assets, $33 Billion Assets in just 10 months, Gold ETF was launched in January 2005.