Today crash related news

Today crash related news

Robinhood Halts 24-Hour Trading Service Due to Market Volatility

Robinhood halted its 24-hour trading service amid global market volatility. This development coincided with factors such as the Bank of Japan’s interest rate hike and geopolitical tensions in the Middle East. Cryptocurrency markets and stocks experienced significant declines.

Hackers use stolen funds to buy ETH amid price crash

As the price of ETH dropped over 20% on August 30, hackers utilized the opportunity to purchase ETH at a lower price using stolen crypto. The hackers behind the 2021 Pancake Bunny exploit bought 2.922K ETH for 7.8M DAI. Similarly, the attackers of the $200 million Nomad hack also acquired ETH, spending 39.75 million DAI to acquire 16,892 ETH. These transactions were made as ETH experienced its largest price drop in 2024, presenting a buying opportunity amidst a broader market downturn that saw over $1 billion in liquidations in 24 hours.

Market makers sold over $300M Ether as ETH price crashed below $2,200

Market makers’ Ether selling patterns have significantly contributed to the current crypto market decline.

Five of the top market makers have sold a total of 130,000 Ether worth $290 million at today’s price since Aug. 3, while Ether’s price crashed from $3,000 to below $2,200.

The market makers include Wintermute, which sold over 47,000 ETH, followed by Jump Trading with over 36,000 ETH, and Flow Traders, with $3,620 ETH, in third place.

GSR Markets also sold 292 ETH, while Amber Groupd sold 65 ETH, according to a research note by 0xScope shared with Cointelegraph.

While Jump Trading was the first to start selling, Wintermute sold significantly more Ether, noted 0xScope

Aave nets $6m in revenue amid crypto plunge

Decentralized finance protocol Aave generated more than $6 million in revenue as the crypto prices plummeted.

Stani Kulechov, founder of Aave, said in a post on X on Aug. 5 that the DeFi protocol secured the revenue after navigating the crypto market plunge that had investors reeling on Monday. Aave, which traded higher to hit $117 on Aug. 2, followed by lows of $79 on Aug. 5 amid a crypto crash.

Justin Sun refutes liquidation rumors after $280 million loss from Ethereum crash

According to Sun, his team does not engage in leverage trading as they prefer to adopt trading strategies that benefit the entire crypto industry. He said:

“The rumors about our positions being liquidated are false. We rarely engage in leveraged trading strategies because we believe such trades do not significantly benefit the industry.”

The TRON Network founder pointed out that his team was more involved in staking, working on crypto projects, providing liquidity to crypto protocols, and running blockchain nodes. To support his point, he added that his team will create a $1 billion fund to “combat FUD, invest more, and provide liquidity.”

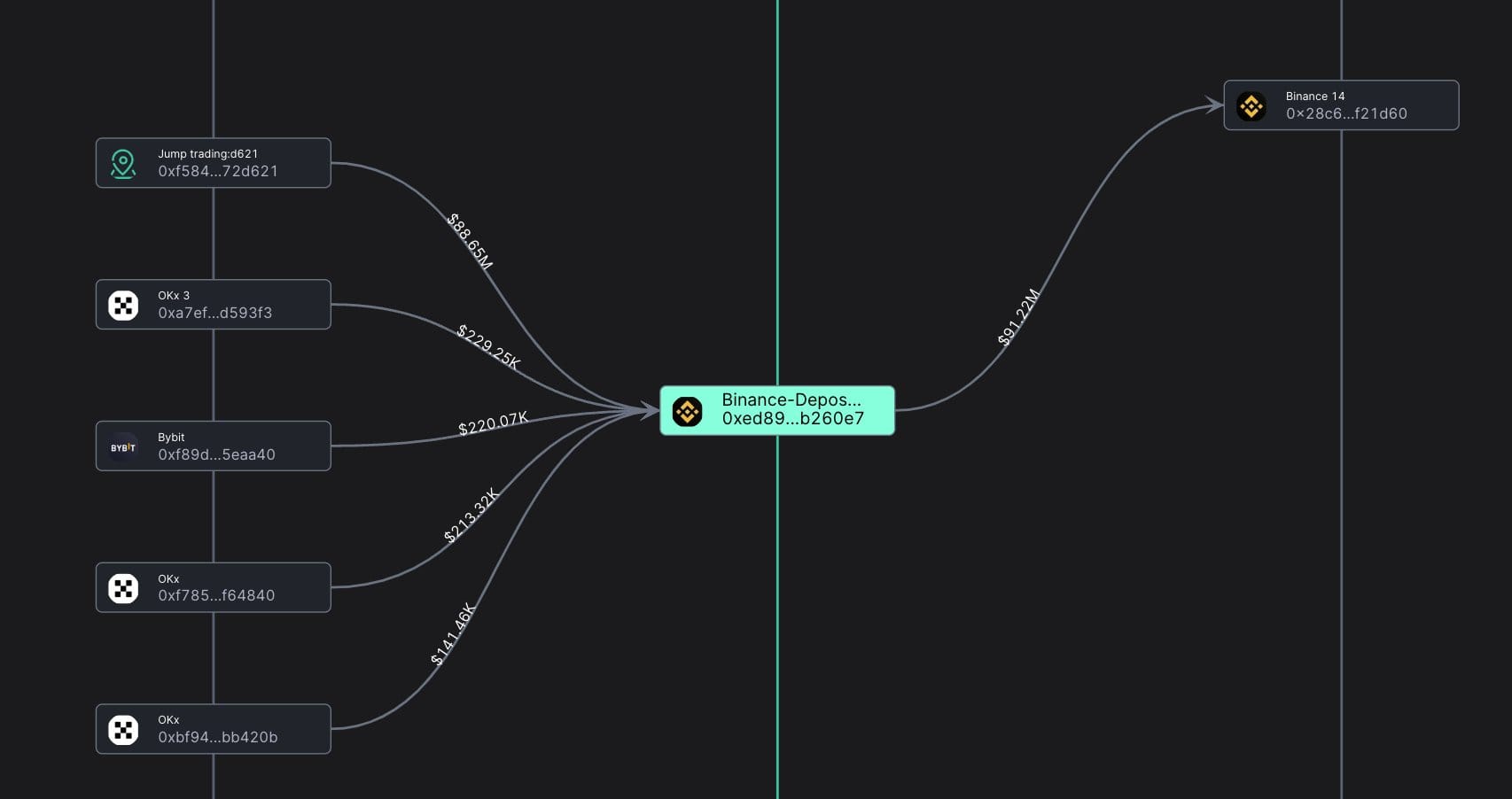

Why Did Jump Trading Dump $314 Million in Ethereum Overnight

Jump Trading has recently unstaked and sold off a significant portion of its Ethereum holdings, totaling approximately 120,000 ETH, valued at around $314.8 million. This move comes during a period of notable decline in Ethereum’s price, which has dropped by over 30% since the unstaking began.

Data from analytics firms Lookonchain and Arkham Intelligence indicated that these Ethereum tokens were removed from a specific redeem address just a day after the U.S. saw the launch of spot Ether exchange-traded funds (ETFs).

Despite this large-scale movement, Jump Trading still retains a substantial Ethereum reserve, holding 37,604 ETH tokens, currently valued at about $104 million.

The rationale behind Jump Trading’s decision to unstack and sell a portion of its Ethereum stash appears linked to ETH previously compromised in a hacking incident over a year ago. Reports suggest that the firm managed to regain control of these funds through strategic counter-trading efforts.

Although the exact reasons for the sale remain somewhat opaque, it is important to note that Jump Trading is under investigation by the U.S. Commodity Futures Trading Commission (CFTC), though no specific charges have been made public.