This Teen Crypto Investor Lost $6B in Bitcoin. Then Something Awesome Happened

Despite the setback, Zhao did not give up. A self-taught coder, he created his own Bitcoin exchange, Bitcoinica, in just four days

Meet Zhao Tong, a 16-year-old coder who became enamored with Bitcoin a decade ago, primarily because the cryptocurrency can be transferred across nations without needing an annoying intermediary. However, purchasing Bitcoin was challenging back then, as there weren't many crypto exchanges. And those that were operational, such as the now-defunct Mt. Gox, suffered frequent outages and security issues.

Tang was one of Mt. Gox's customers. Unfortunately, he bought Bitcoin for the first time right before the infamous Mt. Gox flash crash, which caused the price to drop to $0.01 per token. As a result, Tang lost what could have been $6 billion worth of Bitcoin at current rates.

Zhao Tong launches Bitcoinica

Despite the setback, Zhao did not give up. A self-taught coder, he created his own Bitcoin exchange, Bitcoinica, in just four days. Bitcoinica was not just another exchange; it allowed for margin trading, allowing traders and miners to speculate on future prices. Users could bet as much as 50 BTC instantly.

Within days, Bitcoinica's volume soared. It traded as much as $40 million a month, second only to Mt. Gox. Zhao earned $10,000, or about 2,000 BTC, in just the first two weeks.

Security concerns arise

However, not everyone trusted Bitcoinica. Some worried about Zhao's age and experience, questioning the security measures in place. One forum user wrote, "How can a 17-year-old incorporate a company?"

Despite skepticism, Bitcoinica traded hundreds of thousands of Bitcoin each month. But when Zhao was approached by investors in late 2011, he sold the company. He was still in school and busy with exams.

The new owners, Wendon Group, had concerns about Zhao's work. They sought help from veteran Bitcoin developers to audit the exchange. Among them was Amir Taaki, an outspoken hacktivist who supported WikiLeaks and 3-D printed guns.

Wendon Group wanted to show their commitment to Zhao and Amir by investing heavily. They even paid $1 million for the industry's most sought-after domain: Bitcoin.com.

The devastating hacks

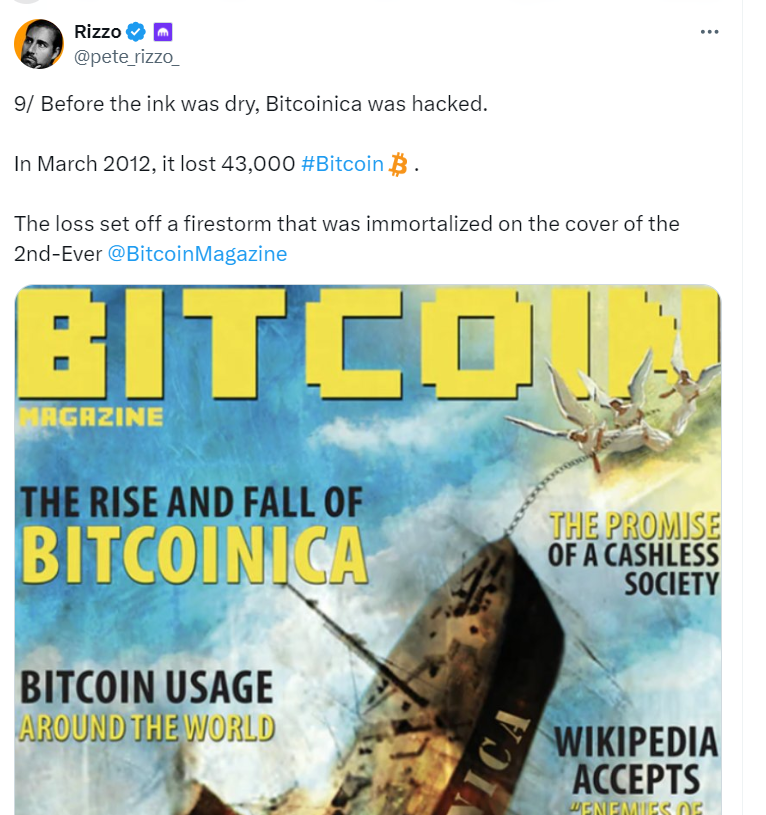

Before the ink was dry, Bitcoinica was hacked. In March 2012, it lost 43,000 BTC. The loss was featured on the cover of the second-ever Bitcoin Magazine.

Things got worse. Later that March, Bitcoinica's servers were attacked two more times. The thieves stole 48,000 BTC. This was before hardware wallets or multisig: all the hacker had to do was reset a few passwords.

The aftermath and Zhao's legacy

Who was to blame? Zhao? Wendon Group? Amir? Users didn't care - they just wanted their Bitcoin back. Some lost over 24,000 BTC.

Today, what exactly happened remains a mystery. Zhao emphasized the need for personal security for Bitcoin users and businesses. He said, "Bitcoin users and businesses need to take their personal security seriously."

Zhao's reputation was destroyed. His name became one of the first viral Bitcoin memes. Among OGs, the phrase "Zhao Tonged" is used to describe investors who have been robbed and cheated.

The importance of security in the crypto world

Zhao's last act was to take 1,000 BTC and invest it in a rare solid gold Casascius coin. He owns one of only three of these rare collectibles, which today are valued at over $60 million. Then, he left the industry.

Exchange hacks continue today. Serious Bitcoin investors are recommended to use hardware wallets or multisig custody. These setups reduce the risk of exchange hacks.

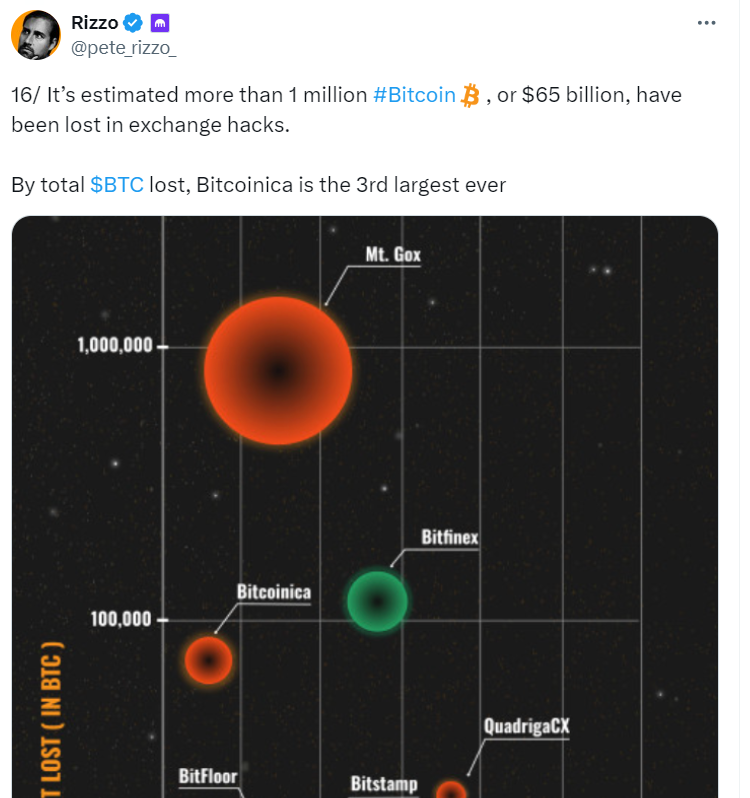

It is estimated that more than 1 million BTC, or $65 billion, have been lost in exchange hacks. By total BTC lost, Bitcoinica is the third largest ever.

Today, Bitcoinica remains a $6 billion reminder. Take your custody seriously. Use multisig security. Don't get "Zhou Tonged."