Fidelity is valuing ETH as mone

C = What users are spending as gas, to use Uniswap or mint an NFT. I = The quantity of staked assets or capital in liquidity pools. G = Ethereum Foundation expenditure, issued ETH to validators. X-M = How much stablecoins are minted/burned, bridge flows to/from other chains and DePIN rewards

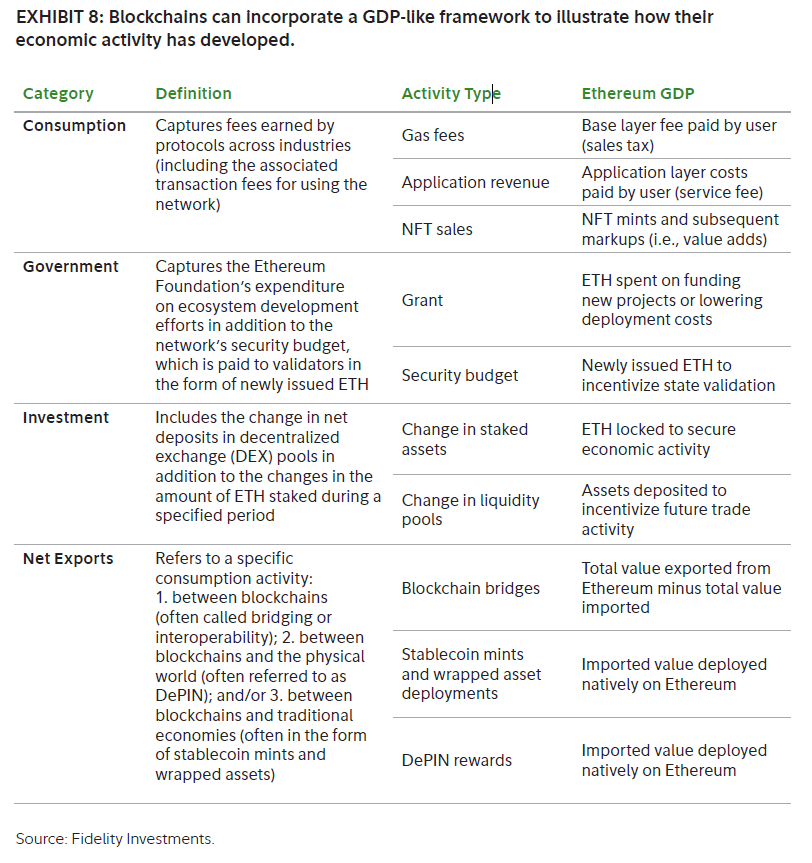

A recent report by Fidelity Investments proposes valuing blockchains on the basis of GDP:

“… it is more appropriate to compare decentralized blockchains to sovereign nations and their economies rather than web2 companies or products because of the embedded currency.”

Here’s the GDP formula: C + I + G + (X-M)

C is consumption, I is business investment, G is government spending, X is exports and M is imports, so X-M is net exports.

Fidelity uses ETH as an example. So, when you transpose the GDP formula onto Ethereum blockchain metrics:

C = What users are spending as gas, to use Uniswap or mint an NFT.

I = The quantity of staked assets or capital in liquidity pools.

G = Ethereum Foundation expenditure, issued ETH to validators.

X-M = How much stablecoins are minted/burned, bridge flows to/from other chains and DePIN rewards.