Cross Border CBDC Project Mbridge Enters MVP Stage

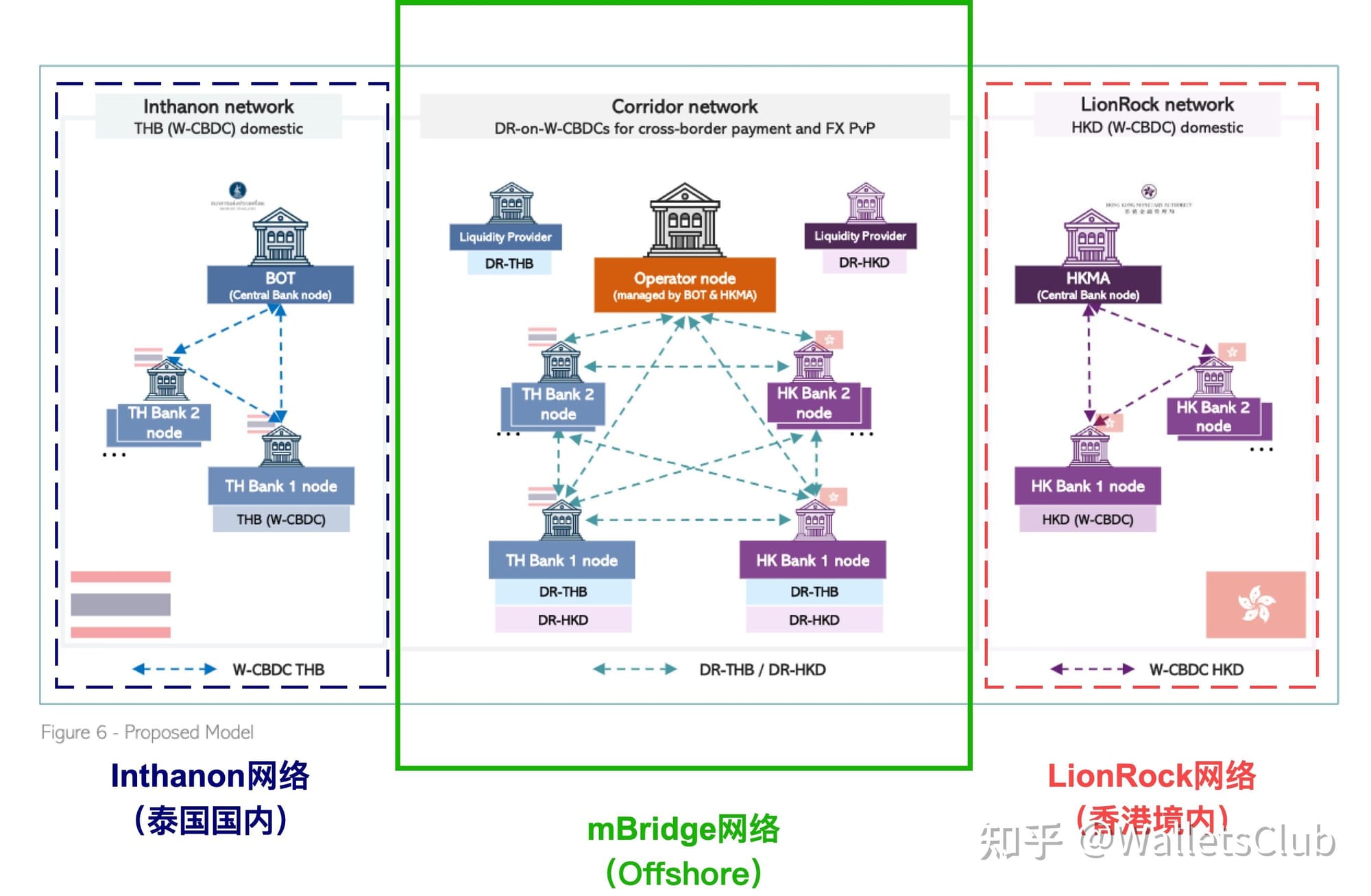

Each one of the institutions involved in Mbridge is now running a validator node in the platform, and, pending regulatory approval in each jurisdiction, it can move value through the network

Project Mbridge, a cross-border central bank digital currency (CBDC) transactional platform, has reached its minimum viable product (MVP) stage, featuring now a basic range of functionality in its infrastructure.

The project, which started as a pilot in 2021 with the collaboration of the Bank of Thailand, the Central Bank of the United Arab Emirates, the People’s Bank of China (PBOC), and the Hong Kong Monetary Authority (HKMA), is now ready to intermediate real-value transactions, according to a press release issued by the Bank for International Settlements (BIS).

Each one of the institutions involved in Mbridge is now running a validator node in the platform, and, pending regulatory approval in each jurisdiction, it can move value through the network. In February, the project reached a milestone when it was used to settle the first digital dirham cross-border settlement, paying $13.6 million directly to China.

This new stage also includes the addition of the Saudi Central Bank as a full participant in the project, expanding its scope to a multibillion-dollar trade market. The BIS is now inviting private firms wishing to contribute to the project, allowing proposals that can innovate and help the platform “reach its full potential.”

Mbridge, which aims to use CBDC rails to solve the current inefficiencies and complexities of the bank-based payment system, including slowness, high costs, and long settlement times, has awakened concerns regarding its enabling possibilities.