SBER has opened access to digital financial assets for individuals

BEAC, Russia's largest bank, has provided all individuals with the opportunity to register on the Digital Financial Assets (CFA) platform.

BEAC has opened access to its digital asset platform to all private investors, and investors who have received the status of a qualified investor in relation to the CFA are already making their first transactions on it.

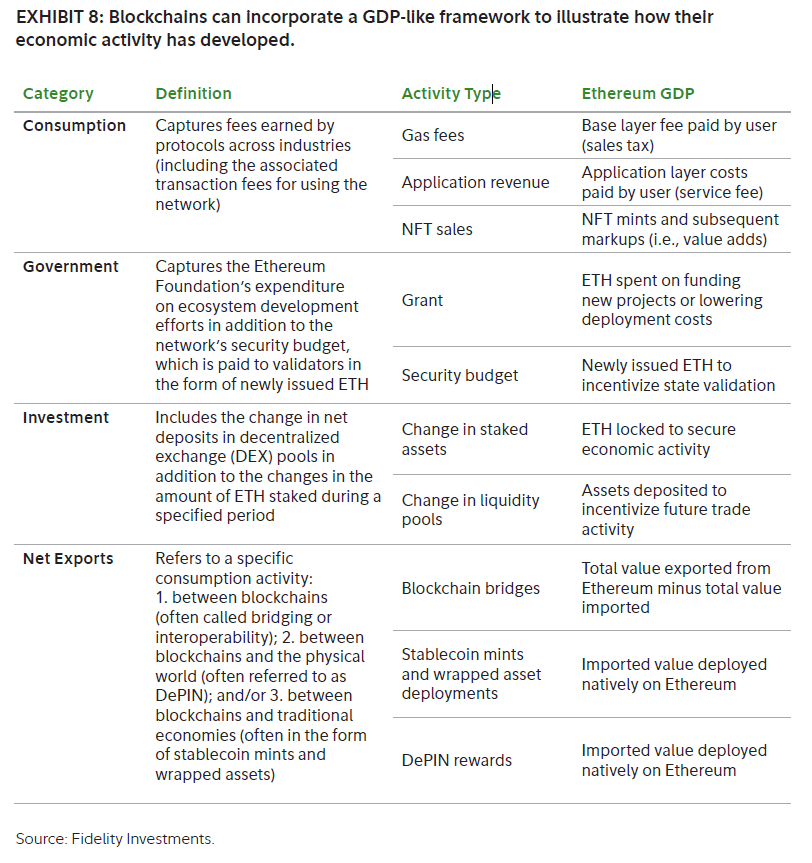

Digital financial assets (CFAs) are digital analogues of familiar contracts and securities, for example, loans, bonds, stocks, futures. With the help of CFA, you can create products that cannot be put into circulation on a regular exchange. For example, "tokenized" rights to square meters or precious metals.

The main difference between CFA and classic securities is that they are fully digitized and issued on the blockchain using smart contracts.

The issue and circulation of the CFA is regulated by Law No. 259-FZ "On Digital Financial Assets, Digital Currency and on Amendments to Certain Legislative Acts of the Russian Federation" dated July 31, 2020. It entered into force on January 01, 2021.

The law allows information system operators to issue CFAs on special licensed platforms; to organize CFAs auctions on special licensed platforms; to acquire and sell CFAs to individuals and legal entities.

Formally, CFA has been issued in Russia for two years now — since February 3, 2022, this is the date of the appearance of the first operator in the registry, but in fact the release of CFA began in April 2022.

The first Russian blockchain platform to be certified for the application of Russian cryptography standards and to receive the status of a qualified certification center from the Central Bank of Russia was the Masterchain platform. In turn, the CFA banking platforms are registered on the Masterchain.

Source: https://hashtelegraph.com/sber-otkryl-dostup-k-cifrovym-finansovym-aktivam-dlja-chastnyh-lic/