Base blockchain exploit leads to $1M theft

“The oracle used by these contracts was not robust, relying only on a single pair with a limited liquidity of ~$400K, making it susceptible to price swings that could be manipulated.”

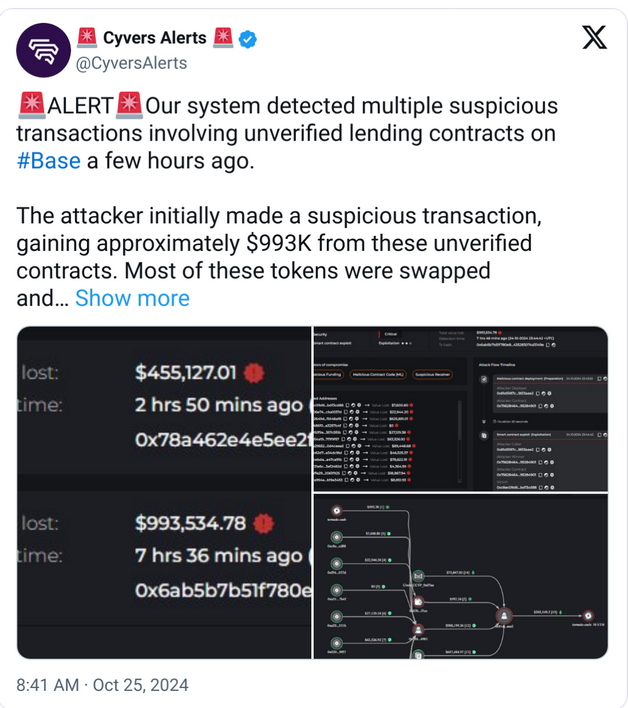

An exploit involving unverified lending contracts on the Base blockchain resulted in the theft of about $1 million.

The incident, which took place over several hours, was reported by blockchain security firm Cyvers Alerts in an X post on Oct. 25.

The attacker exploited a vulnerability in the smart contracts related to Wrapped Ether (WETH), successfully manipulated the price and then siphoned the funds.

Price manipulation exploit

The attacker’s initial suspicious transaction extracted $993,534 from the Base blockchain’s unverified lending contracts.

They moved most of the stolen funds to the Ethereum network and then deposited $202,549 into the privacy-focused Tornado Cash service. Additional funds totaling $455,127 were taken using the same exploit.

In a written Q&A Hakan Unal, senior SOC lead at Cyvers Alerts, explained the vulnerability exploited in the attack:

“The oracle used by these contracts was not robust, relying only on a single pair with a limited liquidity of ~$400K, making it susceptible to price swings that could be manipulated.”