Aurum Launches $1B Tokenized Fund on XRP Ledger

This initiative leverages the XRP Ledger, a decentralized and open-source Layer 1 blockchain, to power real-world asset tokenization for data center investments

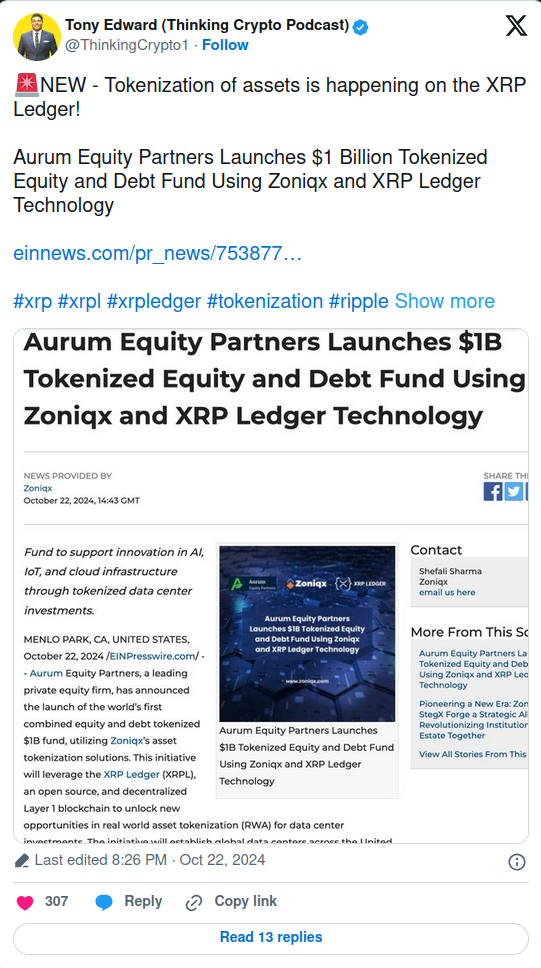

Aurum Equity Partners launched a $1 billion tokenized equity and debt fund on the XRP Ledger, an enterprise-grade blockchain network linked with Ripple.

The Fund will seek investments in data centers across the US, the UAE, Saudi Arabia, India, and Europe. It has been heavily promoted as the “world’s first combined equity and debt tokenized fund” that allows investors to engage in a hybrid model by utilizing both asset classes via blockchain technology.

Aurum Launches $1B Tokenized Fund on XRP Ledger.

Aurum Equity Partners unveiled the world’s first hybrid equity and debt tokenized $1 billion Fund, powered by Zoniqx’s asset tokenization technology.

This initiative leverages the XRP Ledger, a decentralized and open-source Layer 1 blockchain, to power real-world asset tokenization for data center investments.

The project will set up data centers across key regions such as the United States, United Arab Emirates, Saudi Arabia, India, and Europe; therefore, this has been one of the major applications of blockchain in better managing and accessing conventionally illiquid assets such as private equity and debt.

This new launch marks a vital milestone in the growth trajectory of both the XRP Ledger and Ripple Labs, proving their ambition to tap into the growing RWA tokenization market.

More recently, institutional interest in exploring Blockchain applications for classical financial instruments such as bonds and equity, operating efficiently and offering faster settlements around the clock, has caught new attention. McKinsey, BCG, and other reports forecast RWA markets to grow to trillions of dollars over the coming years.